|

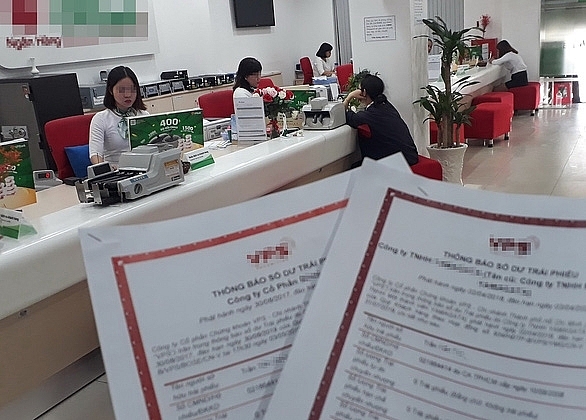

| some businesses push up interest rates of bond issuance to mobilize capital. Source: Internet |

According to the Ministry of Finance, recently, although the legal framework has been fully promulgated, the problem of law enforcement is not strict, leading to cases of violations. Through management and supervision, the Ministry of Finance assessed the corporate bond market and risks associated with each participant in the market.

For example, some businesses push up interest rates of bond issuance to mobilize capital, despite their weak financial situation; many individual investors intentionally violate to become professional investors in order to buy private placement corporate bonds or contribute capital through the form of investment cooperation contracts with professional securities investors under civil law; some service providers do not comply with the law, legalized the offering documents or solicited the wrong investors for private placement corporate bonds.

The Ministry of Finance emphasized that the biggest risk in the market today was the risk from individual investors who lack the ability to analyze and assess the risks of bonds but still participate in buying corporate bonds. On social networks and groups recently there has been a phenomenon of brokers of some businesses and financial institutions inviting people to buy corporate bonds as a form of savings with the offer to help bend the law to become professional investors.

Faced with the fast-growing and risky corporate bond market, the Ministry of Finance has recommended that investors participating in the individual corporate bond market should be cautious, learn about legal regulations and the capacity of business results of the issuing company, and understand the risks to corporate bonds before making decisions on investment.

For individual investors, when considering buying corporate bonds, the Ministry of Finance said it should pay attention to five important points.

Firstly, corporate bonds are not bank deposits; corporate bonds are issued by enterprises on the principle of self-borrowing, self-repayment and self-responsibility for debt repayment ability. Therefore, investors buying corporate bonds are at risk when the enterprise cannot guarantee the obligation to repay the bond principal and interest.

Secondly, when bonds are introduced as private placement corporate bonds, investors must note that the law only allows professional investors to buy private placement corporate bonds. If investors are not professional investors, they are not allowed to buy this type of bond.

Thirdly, the distribution of credit institutions and securities companies offering to buy corporate bonds does not mean that these organizations guarantee the safety of buying bonds. These organizations are just service-providing enterprises, enjoying service fees from the issuer without responsibility for the debt repayment ability of the issuer.

Fourthly, bond underwriting is not a bond payment guarantee. Underwriting is just a commitment to the issuing enterprise to distribute the number of bonds to be issued, without any obligations to investors. For payment guarantee, investors also need to carefully understand the scope of the guarantee (guarantee to pay principal, interest, or only part of principal and interest and investors will have to bear the risk for the rest).

Fifth, collateral assets of corporate bonds or credit loans come in many types such as real estate, shares, stocks, investment programs and projects, etc. On the individual corporate bond market today, most of the collateral is real property and programs, projects, securities or a combination of assets (real estate and securities).

Information about collateral issued by enterprises is mentioned in the information disclosure. investors need to learn carefully about the conditions of the collateral, the quality and value of the collateral and the commitments of the issuer.

“Investors should note that, for collateral assets that are projects, assets to be formed in the future or stocks, when the stock market or real estate market has many fluctuations, the value of collateral assets may be reduced and not enough to pay principal and interest on bonds,” the Ministry of Finance noted.

With the above notes, before participating in the corporate bond market, individual investors must self-assess that they are capable of fully assessing the risks of investing in corporate bonds. They do not buy bonds through offerings without carefully researching the financial situation of the issuer and the terms and conditions of the bonds or just buying bonds because of high-interest rates.

Investors must be very careful with forms of solicitation through signing “Bond Investment Contracts” with organizations (securities companies, commercial banks, and other enterprises), in the form of a civil agreement are not considered to be bondholders or follow other forms of investment that are not clear under the law as extremely risky, leading to possible loss of money and not being protected by law.

The Ministry of Finance emphasized that any act of “bending” the law to become a professional securities investor would not only result in many risks and losses when buying bonds (possibly losing all of their investment money), but is also a violation of the law. State management agencies will carry out inspections to strictly handle acts that circumvent these provisions of the law.