|

| Customs officers perform professional activities at Huu Nghi Customs Branch. Photo: H.Nụ |

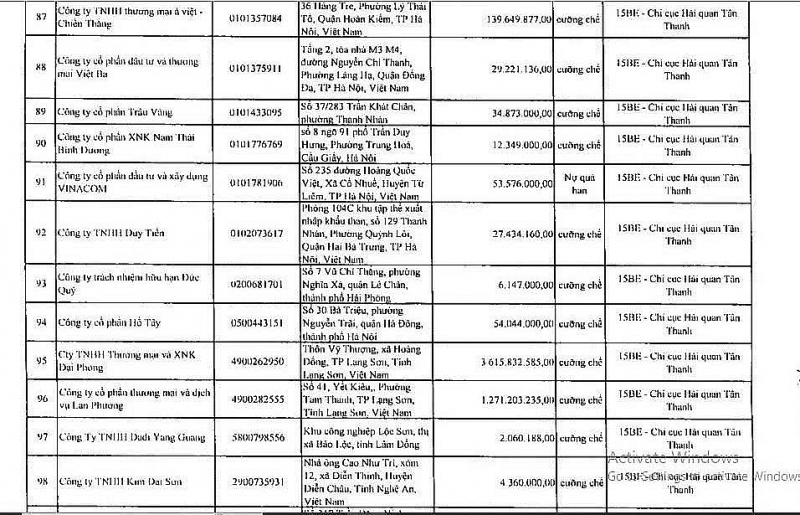

List of 417 “debtors”

The list of businesses subject to enforcement of tax debt, late payment interest, fines for administrative violations, fines for late payment as of January 31, 2024 as required in Official Dispatch No. 1862/TCHQ-TXNK dated April 1, 2019 of Lang Son Customs Department showed that there were 417 enterprises with a total tax debt was VND175 billion.

Among them, several enterprises owing large tax debts such as Bac Son Co., Ltd. Branch located in Phu Nhuan District, HCM City with debts of up to VND23 billion; Bac Son Company Limited that is located in Hai Ba Trung district, Hanoi owing debt of more than VND12.5 billion; Duc Tra Company Limited is located at 161 Dang Van Ngu, Hanoi owing a tax debt of nearly VND8.5 billion; Viet Hoa Paper Joint Stock Company has an address in Tay Ho district, Hanoi owing a tax debt of VND12.1 billion; Trang Huy Company Limited has an address in Bac Ninh City owing a debt of VND5.6 billion; Thanh Long Steel Co., Ltd. has an address in Hung Yen owing a tax debt of over VND5.5 billion; Dai Phong Import-Export Co., Ltd. headquartered in Lang Son owing tax debt of over VND3.6 billion; Trung Viet Automobile Company Limited in Hanoi owing debt of over VND1 billion; Lan Phuong Trading and Services Joint Stock Company (Lang Son headquarters) owed more than VND3.3 billion; Russia-Vietnam Trade Investment Joint Stock Company (headquartered in Quang Ninh) owed VND2.1 billion; Dong Son Industrial Machinery Joint Stock Company (headquartered in Hanoi) owed VND1.9 billion; Thanh Bac Shoe One Member Company Limited owed VND4.4 billion; Thien Lam Shoe Company Limited owed VND3.9 billion; Sinh Hoa Phat Shoe One Member Company Limited owed VND2.42 billion…

Besides businesses owing large tax debts, many businesses owe tax debts of less than VND10 million. For example, Asean Sinotruck Automobile – Construction Machinery Joint Stock Company (Hanoi) currently owes VND7.8 million in tax enforcement debt; Hoa Son Co., Ltd. headquartered in Hanoi incurred a debt of VND7.3 million.

Furthermore, the branch of Hai Duc Bao Printer Material Import-Export Company Limited (Hanoi branch) owes VND5.5 million. It is worth mentioning that Hai Duc Bao Printer Material Import-Export Company Limited, headquartered in HCM City, is also recorded as having a tax enforcement debt of VND3.3 million.

Some businesses with enforcement debt of less than VND1 million are also on this list such as MGM Technology Co., Ltd. (headquartered in Hanoi): Hung Phat Dat 86 Co., Ltd. (headquarters in Lang Son); Man Tien Import-Export Company Limited (headquartered in Hanoi); Anh Minh LS Company Limited (headquartered in Lang Son); Ruby Vietnam Technology Company Limited (headquartered in Hanoi); Dai An Trading Investment Company Limited (headquartered in Lang Son); Xuong Giang Wood Joint Stock Company (headquartered in Bac Giang)…

Even some businesses are listed as recoverable debt because the debt is too small, such as Tien Huy Vietnam Company, HCM City branch, with a debt of only VND152,757. Or An Thinh T&T Company Limited incurred debt of only VND294,560.

According to the reporter’s findings, Bac Son Co., Ltd. is at the top of the list of tax debts that have lasted for many years. The Police agency once prosecuted the case and investigated to clarify the act of intentionally violating state regulations on economic and tax management at this company, including the branch in HCM City, due to making false declaration of localization rate and tax appropriation.

|

| List of enterprises owing tax debts incurred at Lang Son Customs Department. Photo: H.Nụ |

Applying several strong measures

Talking to Customs Magazine, Deputy Director of Lang Son Customs Department Nguyen Huu Vuong said that, most cases of outstanding tax debt arising in the management area of the Department have stopped operating, announced bankruptcy or the legal representatives of businesses that owe taxes are no longer at the previously registered business address or the business leaders are in jail. In addition, some businesses still use the excuse of having difficulties in production and business activities to avoid paying tax debt.

To reduce tax debt to the lowest level, Lang Son Customs Department has implemented many enforcement measures. Besides regulatory measures, the unit actively requests competent authorities to coordinate in implementing tax enforcement against businesses owing tax debt. One of the strong measures being applied by Lang Son Customs Department for tax debtors is exit restriction for legal representatives of businesses. This tax debt enforcement has achieved certain results.

Recently, Huu Nghi Customs Branch has issued many decisions to enforce administrative decisions on tax management by deducting money from accounts and requesting to block the accounts of the subjects being enforced at the State Treasury, credit institutions for many businesses such as Son Lam Pharmaceutical Joint Stock Company, Dai Thanh Trading and Transport Company Limited… because of prolonged tax arrears.

Through the application of measures, Lang Son Customs Department found that only 5 out of 7 enforcement measures were effective. As for the two measures of property distraint, auction of distrained properties and enforcement measures by collecting money and other assets of taxpayers by other organizations and individuals holding while carrying out the asset verification process for enforcement purposes, Lang Son Customs encountered many obstacles.

According to the representative of Lang Son Customs Department, currently, the work of completing dossiers of debt cancellation at the unit is facing some difficulties because the documents have not fully implemented enforcement measures for businesses, owners, and limited partners to determine whether enterprises are no longer able to pay tax debt. In some cases, relevant agencies are slow to respond or do not respond to information that needs to be verified.

Notably, among the 417 sets of documents of enterprises owing tax debt arising at Lang Son Customs Department, each dossier is a different debt with several dozen types of documents, verification results through many stages of tax debt attached with different policies. Thus this makes debt management and collection very difficult.