| Guiding and sharing experiences about risk management in making customs finalization reports |

|

| Representatives of Binh Duong Customs Department answer questions as well as guide businesses on contents related to customs finalization reports. Photo: T.D |

At the seminar “Improving the efficiency of customs settlement report management for enterprises engaged in export processing and manufacturing” jointly held by Binh Duong Customs Department, International Logistics and Logistics Joint Stock Company (INTERLOG) and Vietnam Industry Support Alliance (VISA) on March 20.

Head of Customs Management Supervision Department, Binh Duong Customs Department Do Thanh Phong said that the export processing and manufacturing activities are duty-free import and export activities, which is an incentive policy of the State for long-term investment and business activities.

The management of export processing and manufacturing activities must meet requirements of enterprise management from the enterprise is newly established, put into operation until ceases operations. The imported raw materials, tax-free machinery and equipment from the time of import, put into export production until liquidation and destruction of scrap and waste products are managed strictly in line with the law and guidance documents of the Customs industry.

According to Mr. Do Thanh Phong, the Customs finalization report is the final stage, deciding whether business eligible for tax exemption or not. In order to effectively the key task, enterprises are required to implement effective plans; perform well from the stage of notifying production facilities, preparing documents, registering import-export declarations, recording warehousing and ex-warehousing, and accounting; have an effective management system, closely connecting departments; have a transparent accounting system, reflecting actual economic operations; have strict management software that can monitor and manage the import and export situation at any time; have qualified and experienced human resource.

|

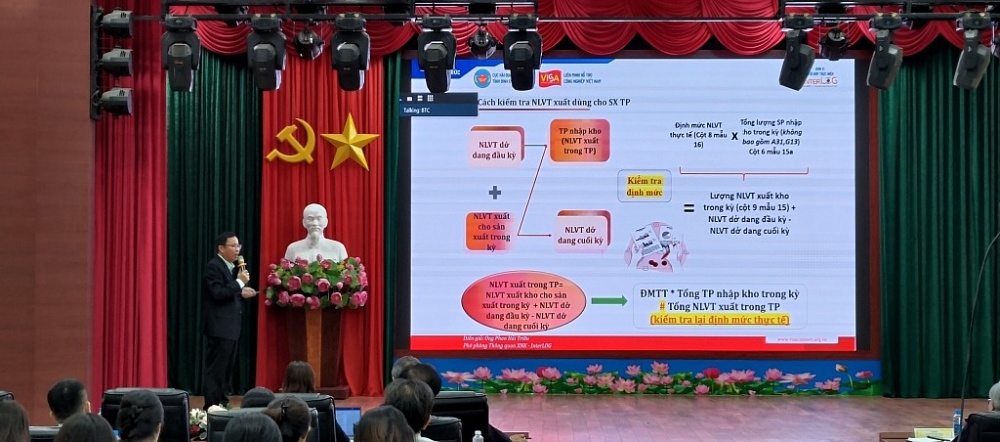

| Customs Procedures Consulting Expert, InterLOG Company talks about the importance of setting norms in customs finalization reports. Photo: T.D |

According to experts, risks in the supply chain are inevitable and may cause damage to businesses if the risks are not detected, and there need have appropriate management methods. In fact, manufacturing enterprises import raw materials into warehouses and export them to serve many different purposes: business, processing, export production… Each finished product needs different input raw materials and the different quantity of ingredients.

Therefore, if the raw material sources, input and output quantities, and waste products are not strictly controlled, it will seriously affect enterprises, causing loss of financial resources due to differences in data. Besides, when the data do not match, businesses will make errors in placing new orders, causing shortages or surpluses in production, affecting the supply chain.

Deputy Manager of Song Than Industrial Park Customs Branch Nguyen Manh Vu recommended that businesses need to proactively grasp information related to the legal framework and export and import tax policies in carrying out customs procedures, and understand cases where goods are exempted from import duty. For export processed and manufactured goods, enterprises are allowed to select the most convenient Customs Branch (as per customs regulations) to carry out import procedures for goods, creating conditions for businesses to have many suitable selections.

|

| The seminar attracts the participation of about 200 export processing and manufacturing enterprises in Binh Duong. Photo: T.D |

Mr. Phan Hai Trieu, Customs Procedures Consulting Expert, InterLOG Company said that “in order prepare Customs finalization reports properly and accurately. First of all, businesses need to have effective internal management methods, closely coordinate with related departments such as accounting department, production department to exchange information, periodically check and handle discrepancies.

Businesses often face difficulties in building norms for scrap collected during the production and recycling process because there are too many codes to handle. Therefore, it is necessary to improve management capacity and the ability to handle situation.

Deputy Head of the Customs Management Supervision Division Pham Manh Thy also mentioned some errors that businesses face in customs settlement reports, and causes and risks affecting business operations.

|

| Business representatives raise problems at the seminar. Photo: T.D |

Specifically, businesses often commit errors such as: bringing raw materials to another facility for processing that is different from the declared site without notification to the Customs authority; storing goods at the locations that are not consistent with the registered locations and with the law; making the report that is not consistent with accounting books, documents, or customs declarations, with actual use and inventory…

At the seminar, the representative of Binh Duong Customs Department directly answered businesses’ problems related to the treatment of scrap, waste products, and excess materials of processing contracts, and norms in settlement reports, changing the purpose of using raw materials…

In the customs control area of Binh Duong Customs Department, more than 1,500 businesses carry out customs procedures for export processing and production for goods as garments, footwear, wooden household appliances, electronic components…, accounting for more than 80% of the total customs declarations at the department.