|

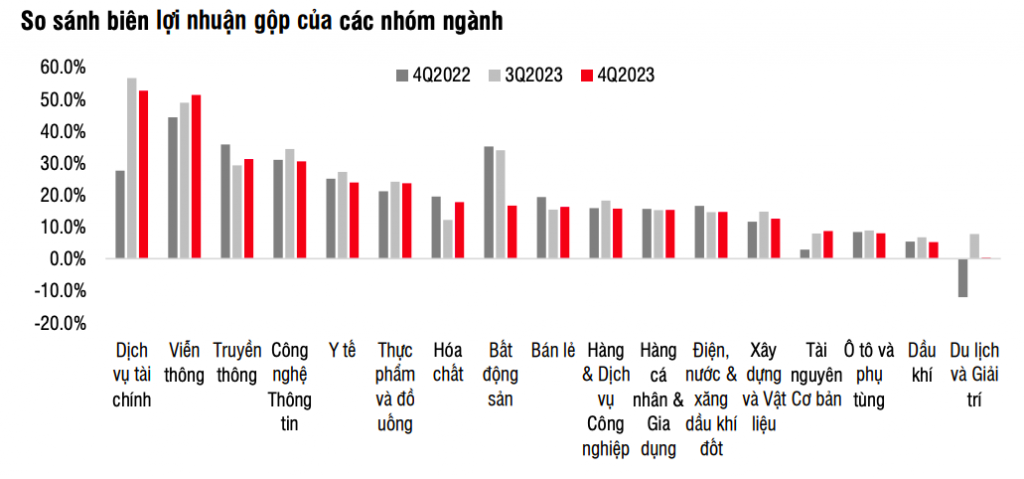

| Gross profit margin of industry groups. Source: SSI Research |

SSI Securities Company has just released an updated report on business results for the fourth quarter of 2023, it shows that banking and information technology are the strongest industries during the recent difficult period.

In particular, the banking industry’s profit in the fourth quarter of 2023 nearly reached the profit peak of the first quarter of 2022 while information technology continued to set a new profit peak. Profit after tax of listed banks increased by 25% over the same period in 2022.

Growth drivers of the banking industry include strong growth in foreign exchange trading profits (up 23%), profits from government bond trading (VND 5.7 trillion compared to a loss of VND 18 billion in the same period in 2022), operating costs were controlled (increased only 1.5%) and provision costs decreased by 4%.

Growth drivers of the banking industry include strong growth in foreign exchange trading profits (up 23%), profits from government bond trading (5.7 trillion VND compared to a loss of 18 billion VND in the same period in 2022), operating costs were controlled (increased only 1.5%) and provision costs decreased by 4%.

Meanwhile, profits of the remaining industry groups are still significantly lower than in the 2021-2022 period. Industrial goods and services (down 12%), retail (down 67%), and automobiles (down 17%) have not yet returned to their growth trajectory. These industry groups all have narrow profit margins while revenue does not change much.

Profit after tax of the Real Estate industry increased slightly by 3% but was still low compared to previous quarters. This increase was largely contributed by sudden financial income while the industry’s revenue decreased by 30% over the same period, it is mainly due to the difference in the time of revenue recognition between quarters. Comparing year-on-year, the real estate industry’s profit after tax in 2023 increased by 5.7% compared to 2022, while revenue increased sharply by 27.3% mainly due to increases in VIC (up 59%) and VHM (up 66%).

SSI also pointed out some industry groups that have confirmed bottoming and recorded significant growth compared to the previous quarter. In particular, the chemical industry increased by 252% compared to the third quarter of 2023, to a level equivalent to the fourth quarter of 2022. Impressive growth is mainly thanks to DHB (up 634% compared to the previous quarter), GVR (up 187%), LTG (up 176%). If excluding extraordinary income, the industry’s gross profit also achieved a quite good increase (up 56% compared to the previous quarter), the highest in the last 4 quarters.

The basic resources industry also recorded the highest profit in 6 quarters, up 34% compared to the previous quarter. This group’s gross profit margin improved to 8.6% compared to 2.8% in the fourth quarter of 2022.

Personal and household goods recorded profit recovery in the first quarter with a growth of 58% compared to the previous quarter and 19% compared to the same period in 2022. Many businesses recorded positive growth such as PNJ (up 149% compared to the previous quarter), GIL (up 566%), VGT (up 68%), RAL (up 101%).

The electricity, water, petroleum and gas industry group also recovered from the bottom of the third quarter of 2023 with an increase of 29%. Many businesses recorded positive growth such as QTP, PPC, NT2, POW, PGV, GAS, VSH.

However, SSI also pointed out that, behind the impressive net profit growth, some points need to be looked at more closely such as the revenue scale has not increased correspondingly. Total market revenue continued to decrease slightly by 2% over the same period, mainly impacted by real estate (down 30% over the same period), food and beverages (down 11%), and chemicals (down 9%), utilities (down 5%). Travel and entertainment is the industry group with the best revenue growth (up 33%) thanks to international tourists gradually recovering after the pandemic.

In addition, gross profit margin (non-financial industry group) decreased sharply from 15.3% in the fourth quarter of 2022 to 14% in the fourth quarter of 2023. However, the decrease was mainly affected by the real estate industry (gross profit decreased by 69%), and the utilities, chemical and retail industries while some industries have had a certain recovery such as basic resources, food and beverages, tourism and entertainment. Excluding financial and real estate industry groups, total gross profit in the fourth quarter of 2023 continued to recover from the lowest level in the first quarter of 2023 and grew by 8.1% over the same period last year.

Another notable point is that abnormal profits increased sharply with total net other income and net financial income reaching VND 26.5 trillion (compared to negative VND 300 billion in the fourth quarter of 2022), contributing to 23% in total profit before tax. These incomes increased significantly compared to the previous period mainly thanks to several businesses such as VIC, VHM, HNG, DHB, and NVL. If these extraordinary amounts are excluded, total profit only increases by 3% over the same period. SSI experts also found that interest expenses decreased in some industries such as food and beverages, basic resources, retail, but increased in real estate, construction and utilities, so the total Interest costs remain high at VND 27.2 trillion in the fourth quarter of 2023 (up 11.2% over the same period in 2022).