|

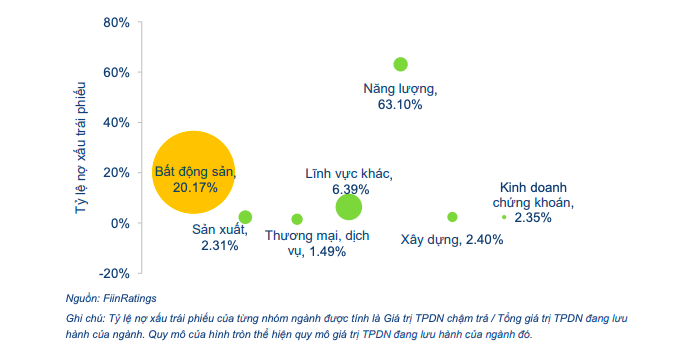

Late payment rate of bonds by sectors |

Bad debt of real estate bonds is over 20%

According to data from Credit Rating Company FiinRatings, as of March 17, 2023, there were 69 issuers with one or more outstanding bonds that were unable to meet their debt obligations with a total value of VND 94,430 billion, accounting for 8.15% of the value of corporate bonds (Corporate bonds) in circulation. In addition, 65 issuers have defaulted on their debt obligations, and 4 issuers have corporate bonds that are due but have been restructured.

Out of a total of 69 issuers with late payment, 43 issuers are enterprises in the real estate industry, with the total value of corporate bonds of late payment at VND 78,900 billion, accounting for 83.6% of the total corporate bond price of the enterprises that are late in paying the bond debt.

The total debt of the above 69 issuers is VND 233,700 billion as of December 31, 2022, of which the total value of outstanding corporate bonds is VND 169,700 billion and the rest VND 64 trillion, is from bank credit and other debt.

Bonds in a late payment situation were worth VND 169,717 billion, accounting for 37% of the total outstanding value of corporate bonds of these enterprises. The remaining bonds that are not due for payment are 75,286 billion dong and have maturities mainly in 2023 (estimated 30,200 billion VND) and 2024 (estimated 21,900 billion VND).

The real estate industry has a bond bad debt ratio of 20.17%, the second highest after the energy industry. However, the real estate industry has the largest circulating scale at VND 396,300 billion, accounting for 33.8% of the total circulating value. In fact, out of 69 issuers that are slow to repay corporate bonds, the number of businesses in the real estate industry accounts for 62.3%.

FiinRating’s analysis, based on data from the financial statements of 33 real estate issuers with late payments, shows that their financial leverage increased by 9.5 times compared to the end of 2017. However, tangible assets – usually profitable assets of real estate companies have a modest increase from VND 25,000 billion (2017) to VND 33,000 billion (2021).

Meanwhile, receivables (usually from lending contracts of related parties) and long-term investments (usually investments in subsidiaries and associates) increased more than quadrupled. Because cash flow is not focused on investing in profitable assets, profits from core businesses do not grow commensurate with debt. As a result, the debt repayment capacity of these enterprises decreased sharply because EBITDA (earnings before interest, taxes, depreciation and amortization) increased only 4 times while debt increased by 15.

For a long time, the above debt has been correlated with EBITDA profit (profit is not close to new cash flow generated in the period) at a very high level, up to 30.5 times in 2020 and 23.5 times in 2021. “This is too high compared to the average maturity of a bond and the debt obligations of these businesses”, – FiinRating’s report emphasizes.

The bad debt of Real estate bonds may continue to increase

Currently, issuers continue to face difficulties due to weak demand while waiting for supportive changes from the Government, such as Decree 08/2023/ND-CP and specific policies on credit line disbursement for 2023. FiinRating experts believe that the above measures will relieve pressure on issuers in the short term, creating conditions to improve liquidity pressure in the long term.

Compared to March 2022, with 17,530 billion VND of privately issued real estate bonds, the issuance of corporate bonds of this industry group has decreased by 97.1% in terms of issuance scale and has not recovered despite the entering 2023, especially in the period from October 2022 to February 2023.

This is also the period when businesses are heavily affected by cases of bond issuance violations, real estate credit control policies, rising interest rates and the issuance of Decree 65 on private placement, increasing the cost of capital and the process of raising corporate bond capital for business activities meets more difficulties than before.

FiinRating believes that the continuation of the above situation may push more businesses, mainly real estate businesses, to delay payment of debt obligations to bondholders in the second and third quarters of 2023 – the peak maturity of a corporate bond of this industry.

Regarding the trend of corporate bonds in 2023 and 2024, FiinRating said that the main concern and risk is VND 396,300 billion coming from 302 real estate businesses.

“The bond bad debt ratio will continue to increase shortly before the policy changes have a direct effect and before the business environment is gradually improved markedly. The reason is that the debt maturity pressure of VND 107,500 billion will be due in 2023, while the business prospect of the real estate industry is facing major obstacles and has not shown any signs of improvement. However, recent support moves such as lowering lending interest rates, Resolution 33/2023/NQ-CP and Decree 08/2023/ND-CP are expected to contribute to solving debt obligation pressure through debt restructuring activities, issuing new bonds to refinance old debts or granting new credits to legally clean projects that are implemented effectively” – FiinRating’s report acknowledged.