|

| Businesses all want to reduce interest rates and increase access to credit. Photo: H.Diu |

The bold move to support businesses

Commenting on this decision of the SBV, Mr. Tim Leelahaphan, economist in charge of Thailand and Vietnam, Standard Chartered Bank, said that the SBV has had better signals to support market liquidity. Besides regulating the economy, the real estate market is also waiting for liquidity support.

Also on this issue, analysts of BVSC Securities Company said that this is a very flexible move by the State Bank in the context that the USD is weaker and the US Federal Reserve (Fed) is likely to increase interest rates and interest rates will be lowered again as soon as 2023, greatly reducing pressure on the exchange rate.

“The fact that the SBV takes advantage of this moment to cut interest rates and support economic growth is a very flexible and timely decision. This move also creates room for interest rates in case the Fed turns to be more “hawkish” than the market’s expectations,” BVSC said.

Dr. Can Van Luc, chief economist at BIDV, member of the National Monetary and Financial Policy Advisory Council, assessed that the interest rate reduction was a “bold” move by the State Bank in the context of the fluctuations of the financial market.

According to this expert, the basis for the SBV to do this is thanks to interest rate pressure, the foreign exchange rate has been gradually decreasing, it is forecast that the FED is likely to raise interest rates slightly in the next term, but the increase may stop, even it will reverse from the second quarter of 2024. Besides, the liquidity of the domestic banking system has improved, creating conditions for some credit institutions to actively reduce deposit and lending interest rates.

Therefore, the reduction of some of these operating interest rates is considered to create more favorable conditions for credit institutions to continue to reduce deposit rates, thereby serving as a basis for reducing lending rates.

|

| Many banks have reduced deposit interest rates. |

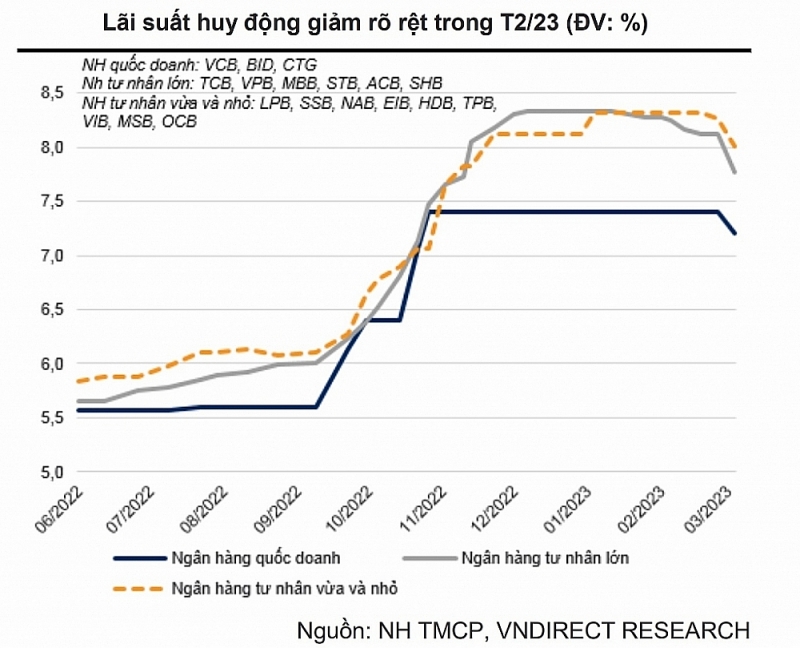

According to the State Bank of Vietnam, many banks have adjusted deposit interest rates down from 0.2-0.5%/year for the term of 6 to 12 months.

As a result, up to now, the newly arising lending interest rate of commercial banks is about 9.4%/year, of which many banks have reduced deposit and lending interest rates.

Not subjective to inflation

The SBV said that the reduction in operating interest rates was made in the context of a slow recovery of the global economy caused by the potential for a recession, and the protracted Russia-Ukraine conflict. The world economy’s growth slowed down with many uncertainties; although inflation shows signs of cooling down and peaking, it still remains at a high level in many economies.

Along with that, the domestic economy faces many difficulties, especially export activities due to slowing world demand, and existing problems of the corporate bond and real estate markets that cannot be resolved soon. Therefore, the reduction of operating interest rates is a flexible solution in line with current market conditions to realize the goal of recovering economic growth.

Speaking at the meeting on credit on March 15, Governor Nguyen Thi Hong said that the State Bank has been very active in directing and regulating the currency, calling for the consensus of credit institutions to reduce interest rates. The State Bank of Vietnam issued a decision to reduce the operating interest rate in an attempt to reduce the interest rate ground.

However, according to the Governor of the SBV, how much to reduce, what policy tools need to be considered specifically because the task of the SBV is not only to control inflation and to reduce interest rates, but also to stabilize the foreign exchange market, ensure liquidity safety for the operation of the banking system. These are important tasks to strengthen foreign investors’ confidence in Vietnam.

However, experts still recommend a number of issues needing consideration, especially inflation control, as well as closely monitoring the Fed’s action on interest rates. Mr. Tim Leelahaphan said that although a rate cut will ease stress in the real estate market and support the economy, globally, the Fed continuing to raise interest rates can cause this issue to become difficult.

In addition, an economist from Standard Chartered Bank recommended that controlling inflation remains the SBV’s top priority, as it is forecast that inflation will continue to increase throughout 2023. That means the SBV may have to support VND to avoid import inflation. He also raised the expectation that the State Bank will increase foreign exchange reserves when given the opportunity after a significant decrease last year.

According to Dr. Can Van Luc, the State Bank should not be subjective with inflation, so it is necessary to continue to coordinate more active fiscal policy with monetary policy to achieve the dual goal of stabilizing and gradually reducing the interest rate level to support growth while keeping inflation under control.