|

| USD/VND exchange rate fluctuations (June 2017 – December 2022) |

Experiencing a challenging 2022

Talking about the management of monetary policy in 2022, one of the three “problems” pointed out by the Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong is how to stabilize the foreign exchange market when the economy is weak. Our economy has a large openness, domestic production depends heavily on imports, the dollar appreciates strongly, Vietnam is in the stage of advanced monitoring of currency manipulation by the US side.

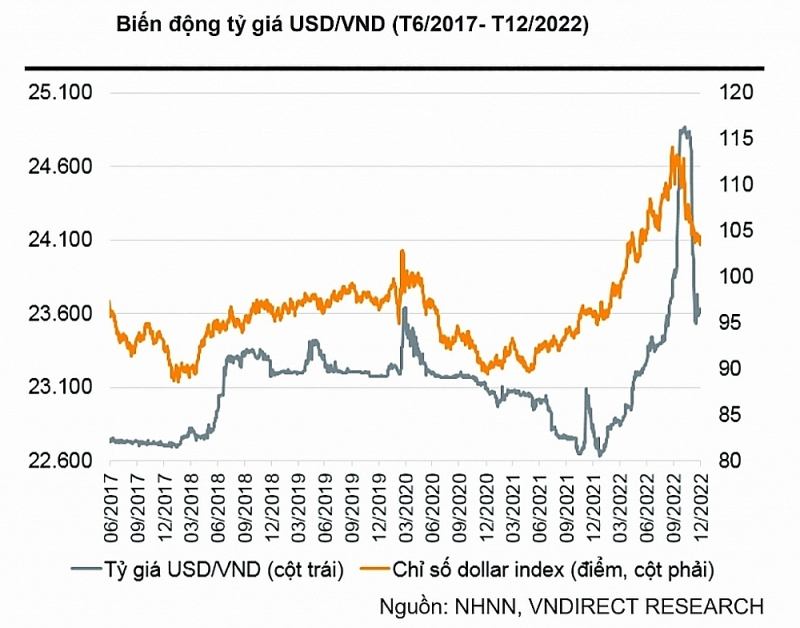

In fact, global economic fluctuations affecting the domestic economy and currency are inevitable. In 2022, to cope with high inflation, the US Federal Reserve (Fed) has continuously increased interest rates up to 6 times. The USD interest rate has reached the highest level since 2007 at 4.25-4.5%. This has supported the greenback to appreciate strongly in the international market. In general, the USD index has increased by nearly 11% in 2022, causing many major currencies to lose value.

According to the Monetary Policy Department, the developments of world inflation and the Fed’s operations put great pressure on investor sentiment, capital outflows put great devaluation pressure on the currencies of emerging countries (including Vietnam).

Therefore, in order to stabilize the foreign exchange market, the SBV has implemented many solutions simultaneously such as increasing the trading band of the exchange rate from +3% to +5% to flexibly allow the VND to depreciate to 9%, being willing to sell foreign currency to intervene, adjusted up 1% of operating interest rates, so that the market has gradually stabilized. So according to the State Bank, in 2022, VND will depreciate about 3.5% – much lower than other currencies in the world and the region.

The VND will not depreciate sharply

Entering 2023, at the meeting on February 2, the Fed continued to raise interest rates by 25 basis points, which pushed the greenback further down. The USD index on the world market tends to decrease, currently moving around 100-103 points, down sharply from 110-114 points in the fourth quarter of 2022, while other currencies such as the British pound, Euro, and Korean Won all increased.

In the domestic market, positive foreign currency cash flows from remittances, disbursement of foreign direct investment (FDI), trade balance helped the exchange rate go sideways, currently trading around 23,280-23,620 VND/USD (buy in – sell out), down about 0.3% compared to the listed level at the beginning of January 2023. The report on the socio-economic situation of the General Statistics Office said that the USD index in January 2023 decreased by 2.05% compared to December 2022, which increased by 3.18% over the same period in 2022.

In the recent 2023 investment strategy report, Rong Viet Securities Company (VDSC) said that in 2023, the dong will not depreciate as strongly as in 2022 because the Fed is expected to end the interest rate hike cycle in mid-2023. Besides, the balance of payments is expected to improve thanks to the trade surplus and the USD index is expected to peak in the fourth quarter of 2022 and the main trend is to decrease in 2023. Experts VDSC forecasts that the USD/VND exchange rate will fluctuate within a narrow band of +/-3% in 2023.

In the latest forex update, Standard Chartered Bank’s report forecasts that the recent rally in the renminbi (CNY) will likely lead to an appreciation of the VND due to the close correlation.

On the basis of the positive signs that have emerged in recent weeks, especially the reopening in China, Standard Chartered revised down its exchange rate forecast. Specifically, the USD/VND exchange rate is forecast at 23,200 VND/USD by the end of the first quarter of 2023 (compared to 24,000 VND/USD in the previous report) and 23,500 VND/USD in mid-2023 (compared to 23,800 VND/USD before).

Meanwhile, UOB’s forecast will continue to maintain the uptrend of USD/VND with a forecast of 25,200 VND/USD in 1Q2023, 25,400 VND/USD in 2Q23, 25,600 VND/USD in the third quarter of 2023 and 25,800 VND/USD in the fourth quarter of 2023. According to Maybank Securities Company, in the first quarter of 2023, the exchange rate was at 23,500 VND/USD, in the second and third quarters it remained at 23,400 VND/USD, in the fourth quarter, it decreased to 23,300 VND/USD.

Maintain export support efforts

With such forecasts, experts say that monetary policy management agencies need to have flexible decisions and solutions to support the economy.

According to Andrea Coppola, the World Bank’s chief economist, the current uncertain and risky global economic context puts Vietnam’s policymakers in a difficult position. It is difficult to balance the need for continued policy support to strengthen the economic recovery with the need to contain inflation and new financial risks. High levels of uncertainty will require the policy mix to adapt to changing circumstances. If the Fed continues to raise interest rates, the SBV may consider allowing more exchange rate flexibility, including a faster reduction in the reference rate. Given persistent exchange rate pressures, direct foreign currency sales can be used very conservatively to maintain foreign exchange reserves.

Besides, the report of VDSC said that the dong is not likely to appreciate in 2023 because the high interest rate environment in developed economies will be maintained throughout the year. In addition, export prospects are poor, so the Government will have an incentive to accept the dong depreciating further or increase foreign exchange hoarding again. Therefore, the easing of the inflation target shows that exchange rate stability will no longer be a policy priority as in 2022.

According to Trinh Viet Hoang Minh, a macro and derivatives analyst at ACB Securities, the exchange rate will continue to be under pressure in the first 6 months of 2023. If the SBV makes other moves, such as increasing interest rates or having more foreign currency inflows such as FDI or cash flows from export activities, international tourists in the last 6 months of 2023, the exchange rate will be stable. By 2024, the most positive signal is the reversal of capital flows back to Vietnam, which will help the exchange rate decrease.

Obviously, Vietnam’s import-export businesses are now assured about the movements of the domestic foreign currency exchange rate. The SBV has also repeatedly affirmed that it will increase the frequency of foreign currency sales to be ready to supplement the supply of foreign currency to the market regularly, creating conditions for the credit institution system to fully and promptly meet foreign currency needs and legal requirements of organizations and individuals, including the demand for foreign currency to import essential items for domestic production and business and export, thereby contributing to stabilizing the market and supporting economic recovery.

In a recent exchange, SBV Standing Deputy Governor Dao Minh Tu said that the SBV will try to maintain stability and ensure harmony for export and import policies, especially creating favorable conditions for continued import and export and attracting foreign capital flows to Vietnam, as well as ensuring the interests of businesses using foreign currencies, ensuring resources that the Government and businesses are borrowing abroad, limiting risks for businesses when the exchange rate fluctuates, limiting market expectations.