|

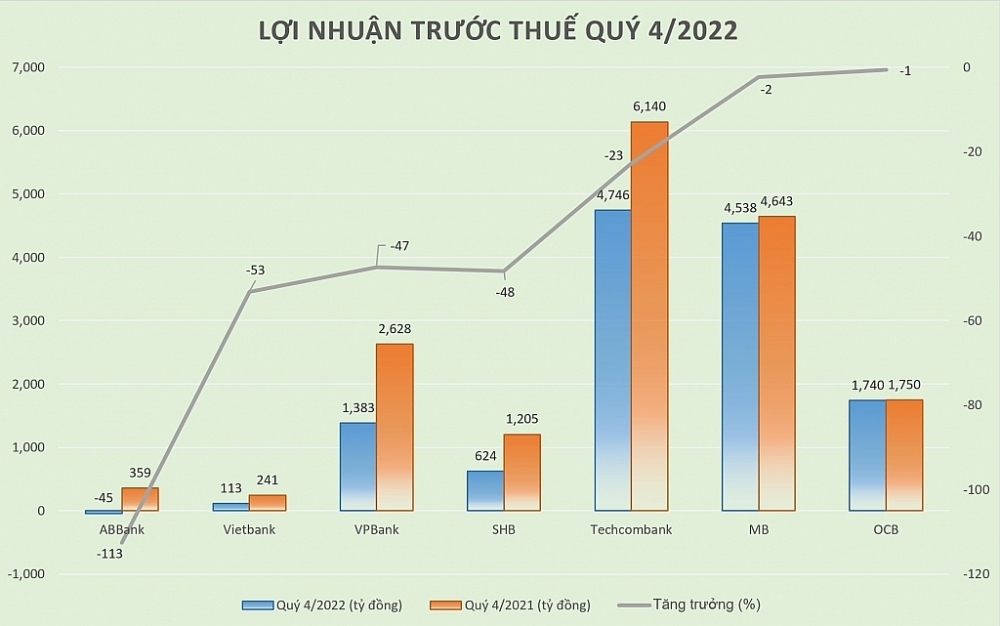

| Pre-tax profit in the fourth quarter of 2022 of many banks decreased sharply. Chart: H.Diu |

As recorded in the financial statements of the fourth quarter of 2022 of banks, the pre-tax profits of An Binh Commercial Joint Stock Bank (ABBank) had the strongest decrease, with a loss of VND 45 billion, down 113% compared to the pre-tax profit of VND 359 billion of the same period in 2021.

The bank explained that income from the government bond business decreased in 2022 due to fluctuations in market interest rates. Foreign exchange business results of this bank also decreased compared to the previous period due to the risk of exchange rate fluctuations.

According to ABBank’s financial report, the main source of revenue was net interest, up 22% compared to the previous year, but off-interest income decreased with profit from service down 34% to VND 232 billion, profit from foreign exchange business decreased by 53% to 193 billion dong. In addition, in 2022, ABBank took nearly VND 249 billion for risk provisions, along with provisions from previous quarters, the bank spent a total of nearly VND 777 billion, up 13% compared to the previous year. With this result, for 2022, ABBank’s pre-tax profit reached more than VND 1,702 billion, down 13% compared to 2021 and only reaching 55% of the set target.

Prosperous Vietnam Commercial Joint Stock Bank (VPBank) also recorded a profit increase of nearly 48% in 2022, reaching VND 21,219 billion before tax, but this growth momentum mainly came from the first months of the year. Thanks to the agreement monopoly on insurance cooperation, VPBank’s pre-tax profit dropped sharply by 47% in the fourth quarter of 2022, compared to the same period in 2021, reaching only VND 1,383 billion.

According to the explanation from VPBank, the profit in the fourth quarter of 2022 decreased mainly due to the decrease in net income from trading of individual investment securities by nearly 103% compared to the same period in 2021. Income from foreign exchange and gold trading activities also suffered a loss of 349 billion dong, while VPBank’s fourth quarter provision expense increased by 31% compared to the same period, to 7,320 billion dong, operating expenses increased by 42% to 4,065 billion dong.

At Military Commercial Joint Stock Bank (MB), the profit of 2022 increased by nearly 38% compared to the previous year but recorded negative growth in the fourth quarter of 2022 (-2%). The reason was that many business activities of MB decreased in income in the fourth quarter, such as income from services decreased by 9%, reaching more than 1,223 billion dong; foreign exchange trading decreased by nearly 13% over the same period last year. In particular, the profit from securities trading decreased by 90%, leading to a decrease of 36% in the whole year, only 141 billion dong was recorded; profit from investment securities also decreased by 60%. In addition, MB also increased provisioning to over 78% in the fourth quarter.

For Saigon – Hanoi Commercial Joint Stock Bank (SHB), the pre-tax profit in the fourth quarter of 2022 also fell sharply by 48%, reaching just over VND 623 billion compared to VND 1,205 billion in the fourth quarter of 2021. The reason why SHB’s Q4 profit dropped sharply came from the decrease in profit from investment securities trading, when it reached only VND 33 billion compared to nearly VND 219 billion in the fourth quarter of 2021, income from other activities also plummeted by more than 84%.

The negative results from foreign exchange business and investment securities trading also caused Vietnam Technological and Commercial Joint Stock Bank (Techcombank) to record a 23% decrease in pre-tax profit in the fourth quarter of 2022 compared to the same period last year. Specifically, foreign exchange business suffered a loss of 304 billion dong, a sharp increase compared to the loss of 27.8 billion dong in the fourth quarter of 2021. Profit from investment securities trading lost more than 106 billion dong, while the same period last year the profit was nearly 332 billion dong, down 132%.

Contrary to banks that went back in profits in the fourth quarter of 2022, there were many banks with strong profits. For example, the National Commercial Joint Stock Bank has “reversed” from a loss of VND 203 billion in the fourth quarter of 2021 to a profit of VND 181 billion in the fourth quarter of 2022; Eximbank also recorded an increase of nearly 2.2 times in profit over the same period to 528 billion dong; In addition, there were PGBank, BIDV, and Sacombank which recorded interest.

According to experts of ACBS Securities Company, in the last months of 2022, the stock market situation was not favorable, causing the profit from securities trading of banks to decline, and at the same time, the liquidity of the real estate market would decrease. The sharp decline in real estate made it difficult for banks to liquidate collateral to collect off-balance sheet debts. In addition, the operating costs of banks, especially staff costs, would continue to increase due to the trend of digital transformation, forcing banks to step up investment in technology infrastructure and attract new employees in information technology and data analytics.

Therefore, many comments said that the profit growth of the banking industry had slowed down in the fourth quarter of 2022 and might last until the first 6 months of 2023. Experts of SSI Securities Company forecasted that profit growth of 2023 of the entire banking industry was likely to be at 10% or one-third of the average growth achieved in the period 2017-2021. According to analysts, the bank’s business situation in the second half of the year would become more positive when interest rate risks and exchange rate tensions eased, liquidity stress was also partly resolved because the Government promoted public investment packages.