VCN – The Hai Phong Customs Department’s revenue dropped between January and September due to the impact of the Covid-19 pandemic. Therefore, the department has made great efforts to provide solutions in the fourth quarter to collect revenue exceeding the whole year’s target.

| Hai Phong Customs cooperates to inspect the collection of seaport fees | |

| Revenue collection at Hai Phong Customs tends to decrease sharply |

|

| The leaders of Hai Phong Customs Department and Hai Phong Port Joint Stock Company sign a coordination regulation in customs management and supervision on October 16. |

September sees record-low revenue

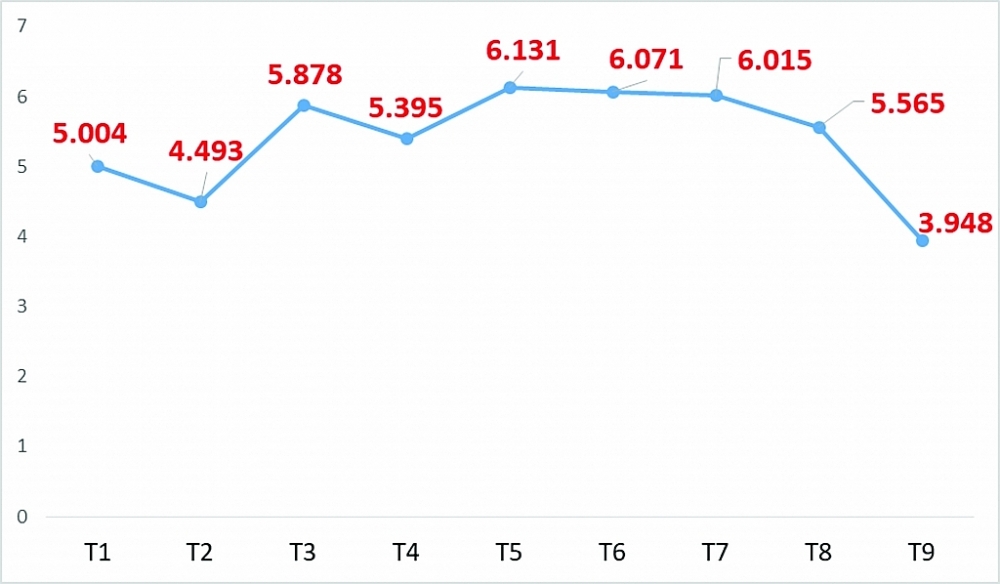

According to Hai Phong Customs Department, from June, the department’s revenue shows a month-on-month plunge. In September, the department’s revenue decreased 29.1% or VND1,617 billion to VND3,948 billion compared with the previous month. Of those, Hai Phong Customs area’s revenue decreased 30.1% or VND1,474 billion to VND3,294 billion; Hai Duong, Hung Yen and Thai Binh areas’ revenues declined 18% or VND143 billion to VND 655 billion.

The department saw record-low revenue of less than VND4,000 billion in September.

In September, the revenue from imported CBU cars dropped 62.5% to VND393 billion compared with August, Head of Import and Export Division under Hai Phong Customs Department Nguyen Ngoc Khanh said.

By the end of September, Hai Phong department saw a year-on-year increase of 21% or VND8,403 billion to VND48,505 billion. This figure met 86.6% of the revenue target assigned by the Ministry of Finance.

Striving to exceed revenue target

Recently, the leader of the local customs department requested customs branches to continue to implement solutions to remove difficulties and facilitate import and export operations of the business community, and strengthen revenue management, prevention of revenue loss and trade fraud.

Customs branches were required to expedite the prevention of revenue loss by supervising and checking the compliance with regulations on customs procedures of businesses, and implementing post clearance audit.

|

| Revenue between January and September in Hai Phong Customs. Chart by: Thai Binh. |

The leader has also asked branches to strengthen customs valuation for high-risk commodity groups on customs value, import and export duty tax rate; effectively implement the pilot scheme on one-time price rulings and using multiple time rulings to facilitate enterprises.

The department has requested branches to strictly control the tax exemption, tax reduction and tax refund; and expedite the inspection of compliance with tax regulations of taxpayers.

It has also asked branch to closely implement the classification and identification of HS code of goods. If goods are declared with preferential tax rates but are ineligible for enjoying the preferential tax rates, they must be subject to normal tax rates.

Hai Phong Customs Department has requested branches to effectively perform tax debt management and classify debt groups in accordance with the direction of the General Department of Vietnam Customs.

By Thai Binh/Ngoc Loan