|

| The Ministry of Finance said that the collection of excise tax on gasoline is in line with the objectives of the excise tax and international practices. Photo: Internet |

Responding to voters’ proposals sent before the 4th and 2nd Extraordinary Sessions of the 15th National Assembly on reducing and abolishing the excise tax on gasoline, the Ministry of Finance said, the Law on Special Consumption Tax stipulates the collection of excise tax on gasoline of all kinds, the non-collection of excise tax on oil and does not stipulate tax reduction or exemption for goods and services subject to excise tax.

The excise tax rate on gasoline is 10%, E5 bio-fuel 8% and E10 bio-fuel 7%.

The Ministry of Finance also said that excise tax is a tax levying on goods and services which are not supported by the State for consumption (cigarette, alcohol, beer), and should be consumed sparingly (fossil-based gasoline) and groups of goods and services consumed by high-income people (cars, planes, yachts, golf).

Further, gasoline is a fossil-based, non-renewable fuel that needs to be used sparingly, so most countries (France, Germany, Italy, the UK, South Korea, Australia, Thailand, Singapore, China, Cambodia, and Laos) all levy excise tax on gasoline.

In addition, in the context of environmental pollution and climate change being global issues, the Vietnamese Government’s commitment at COP26 to achieve “zero” net emissions by 2050, thus, Vietnam’s introduction of gasoline into the subject of excise tax from 1995 is consistent with the objectives of the excise tax and international practices, while the adjustment of the excise tax rate according to voters’ proposals is under the authority of the National Assembly, according to the Ministry of Finance.

Previously, at the 4th session of the 15th National Assembly, the Ministry of Finance submitted to the National Assembly a plan to reduce excise tax on gasoline and value-added tax on gasoline and oil.

However, on November 11, 2022, the National Assembly Standing Committee had a report on the reception, explanation and assessment of the state budget management in 2022 and the state budget estimate for 2023. According to the report, the forecast of the world crude oil price trend in 2023 is lower than in 2022. Besides, along with positive domestic macroeconomic indicators, it is not really necessary to design a “backup” mechanism in gasoline price management through the excise tax and value-added tax.

In addition, in 2023, in addition to measures to regulate the domestic petroleum market, there is still room to use the green tax tool as it did in 2022. Therefore, the National Assembly Standing Committee asks the National Assembly for permission not to add this content to the draft Resolution.

Based on the opinion of the National Assembly Standing Committee and the socio-economic context, the Ministry of Finance reported to the Prime Minister for permission to stop the formulation of the National Assembly’s resolution project on reducing excise tax on gasoline and value-added tax on gasoline and oil.

At the same time, the Ministry submitted to the Government and the National Assembly Standing Committee for promulgation Resolution No. 30/2022/UBTVQH15 on environmental protection tax rates for gasoline, oil and grease. Accordingly, from January 1, 2023 to the end of December 31, 2023, the environmental protection tax rate for gasoline (except ethanol) is 2,000 VND/liter; jet fuel is 1,000 VND/liter; diesel oil is 1,000 VND/liter.

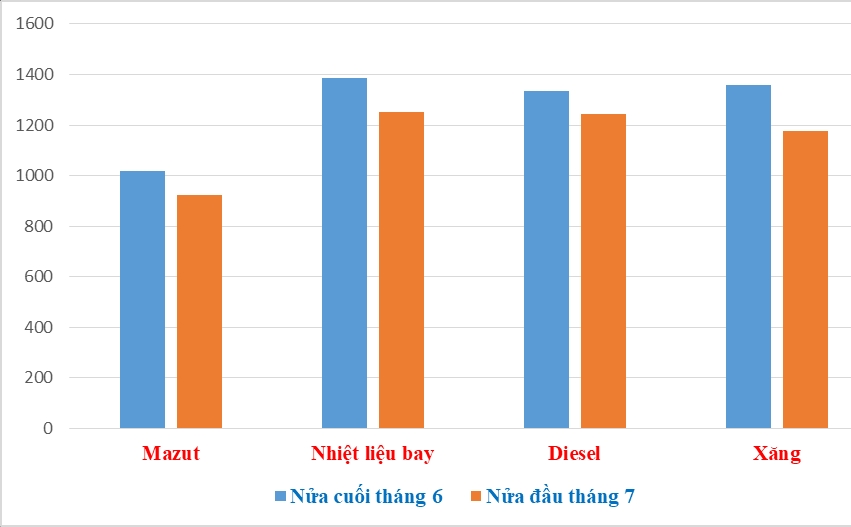

| Prices of imported gasoline decrease by more than VND4 million/ton |

Regarding supply stabilization, Decree No. 95/2021/ND-CP dated November 1, 2021 of the Government amending and supplementing a number of articles of Decree No. 83/2014/ND-CP on petroleum trading provides that the Ministry of Industry and Trade is responsible for determining the demand for total petroleum source of the following year; allocate the minimum total source of petroleum to serve domestic consumption for the whole year according to the type structure to each key trader; responsible for checking and ensuring the minimum total petroleum source for traders, meeting the needs of the economy and the consumption of the society. Therefore, for the stabilization of petroleum supply, the Ministry of Finance proposes that the Ministry of Industry and Trade – the agency in charge and state management on this issue will give an answer.